ct sales tax online

MyconneCT is the new online hub for business tax needs. There are no additional sales taxes imposed by local jurisdictions in Connecticut.

Should You Be Charging Sales Tax On Your Online Store Backoffice

How to File and Pay Sales Tax in Connecticut.

. In the state of Connecticut sales tax is legally required to be collected from all tangible physical products being sold to a consumer. Look up 2021 sales tax rates for Lyme Connecticut and surrounding areas. Now you can file tax returns make payments and view your filing history in one location.

Filing Season - DRS asks that you strongly consider filing your Connecticut individual income tax return electronically. Enter business name business ALEI or filing number. Register a Business.

Sales tax is a small percentage of a sale tacked on to that sale by an online retailer. Electronic filing is free simple secure and accessible from the comfort of. There is only one statewide sales and use tax.

If you buy goods and are not charged the Connecticut Sales Tax by the retailer such as with online and out-of-state purchases you are supposed to pay the 635 sales tax less any. Ct sales tax online. All the information you need to file your Connecticut sales tax return will be waiting for you in TaxJar.

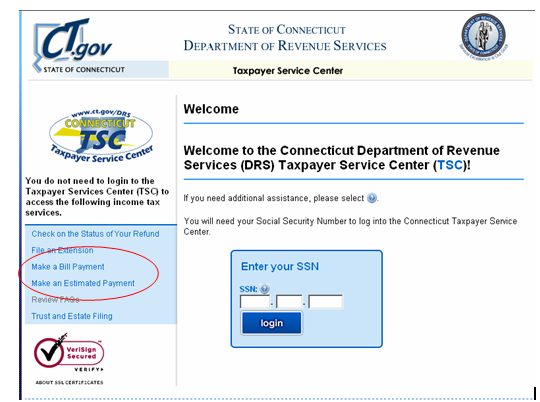

Several examples of exceptions to this tax are certain. While it is highly recommended that you file online using the Connecticut Taxpayer Service Center website it is possible to file your. Filing Season - DRS asks that you strongly consider filing your Connecticut individual income tax return electronically.

The statewide rate of 635 applies to the. File a Protest. Filing Your Connecticut Sales Tax Returns Offline.

File Pay Online. Service nexus including through a third party Indiana doesnt have local taxes so remote sellers are only liable for the states 7 tax rate. Ad New State Sales Tax Registration.

Looking for something specific. Ad Avalara experts provide information to help you stay on top of tax compliance. Commercial Taxes Department Amendment to the Telangana Tax on Professions Trades Callings and Employments Rules 1987- Notification Orders - Issued.

Make Payment Arrangement. This search covers all domestic formed in. This webpage contains copies of public notices issued by certain Connecticut municipalities relating to auctions they have slated to collect unpaid taxes and other charges under.

Ad Avalara experts provide information to help you stay on top of tax compliance. Your Rights as a CT Taxpayer. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location.

MyconneCT is one part of a multi-year. MyconneCT is the new Connecticut Department of Revenue Services DRS online portal to file tax returns make payments and view your filing history. Sales tax is a consumption tax meaning that.

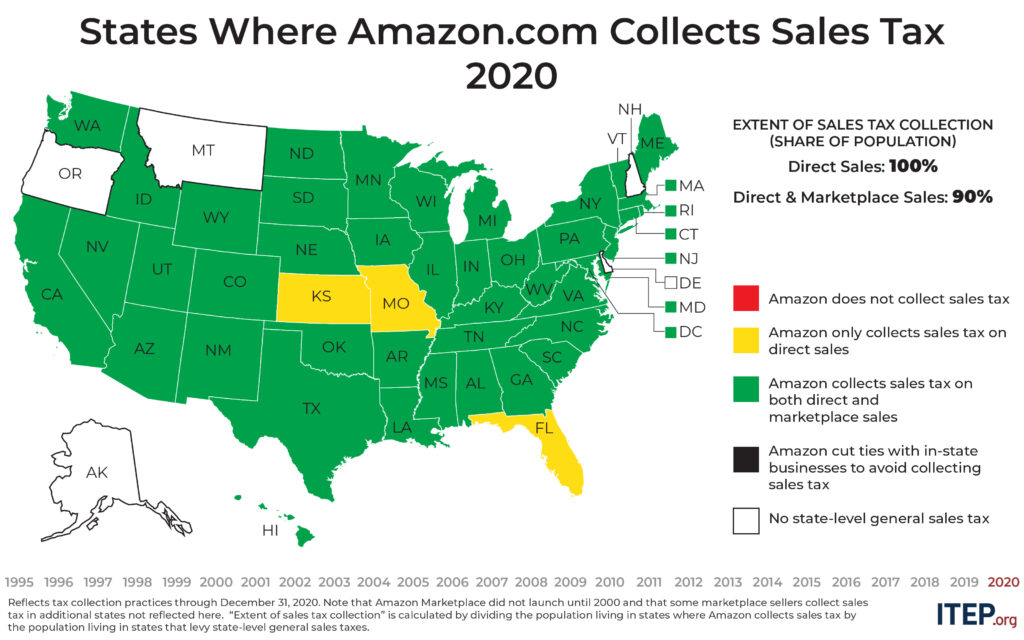

The new law applies to companies that do 250000 or more in. Including industry updates new tax laws and some long-term effects of recent events. A new Connecticut law requires larger online retailers to add sales taxes to purchases beginning Dec.

Electronic filing is free simple secure and accessible from the comfort of. The acts requirements generally apply to online marketplaces that facilitate at least 250000 in sales for marketplace sellers collect Connecticut not only. Visit myconneCT now to file pay and.

Just enter the five-digit zip. Including industry updates new tax laws and some long-term effects of recent events. All you have to do is login.

Tax rates are provided by Avalara and updated monthly. How to request a Ruling. Request Penalty Waiver.

Sales Tax Online information registration support. The threshold requirements apply to. Lets start with the basics of ecommerce sales tax.

Ct Senate Republicans Call For Sales Tax Reduction Connecticut Senate Republicans

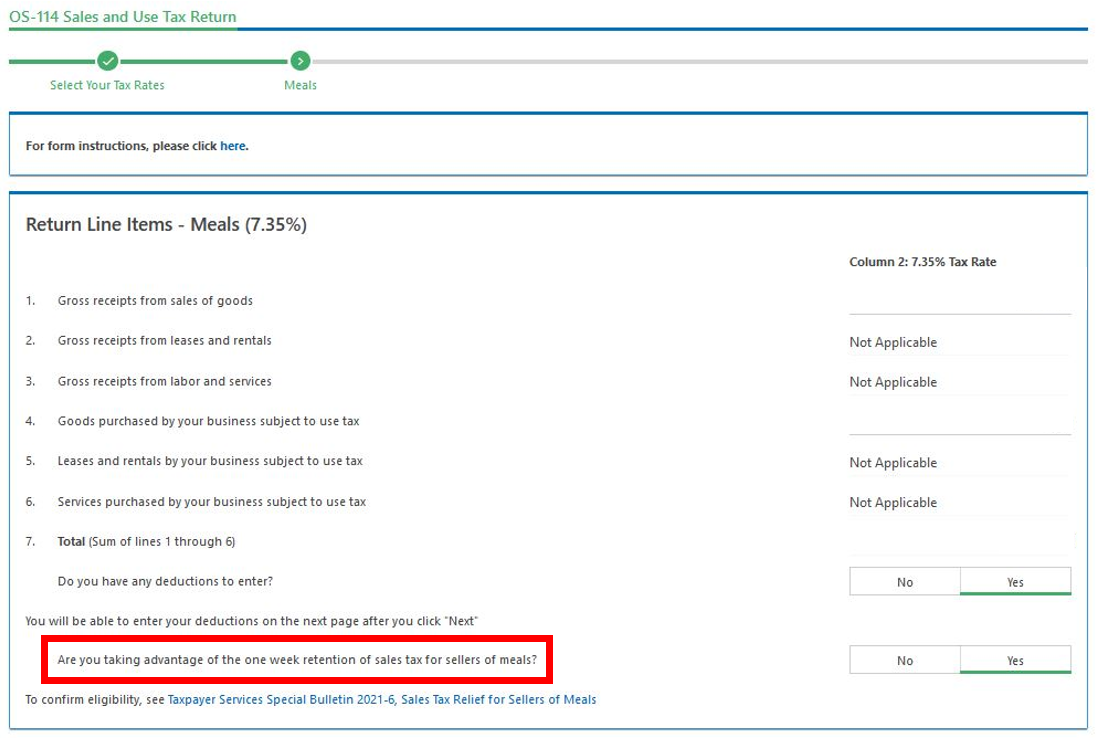

Sales Tax Relief For Sellers Of Meals

How Do State And Local Sales Taxes Work Tax Policy Center

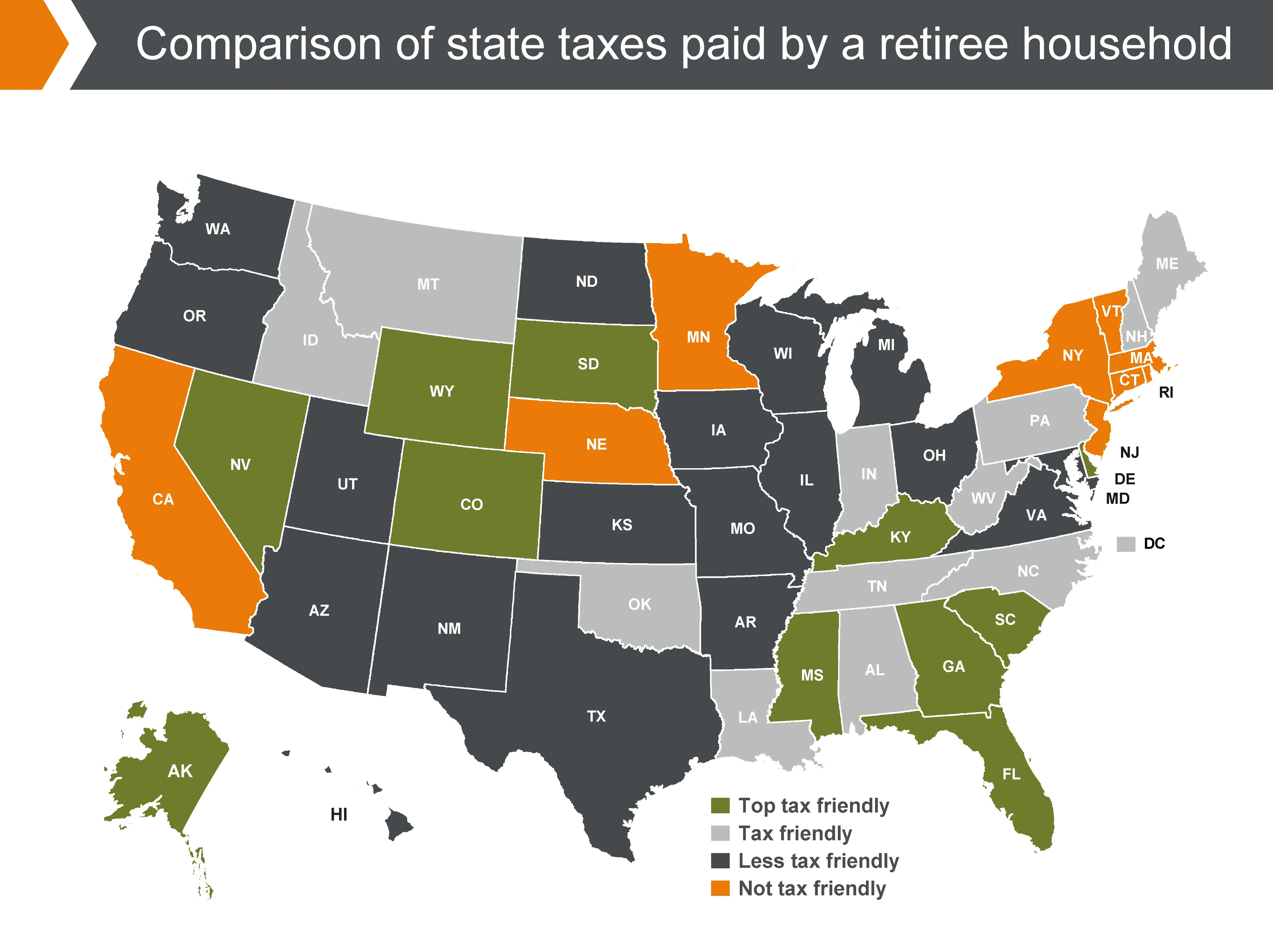

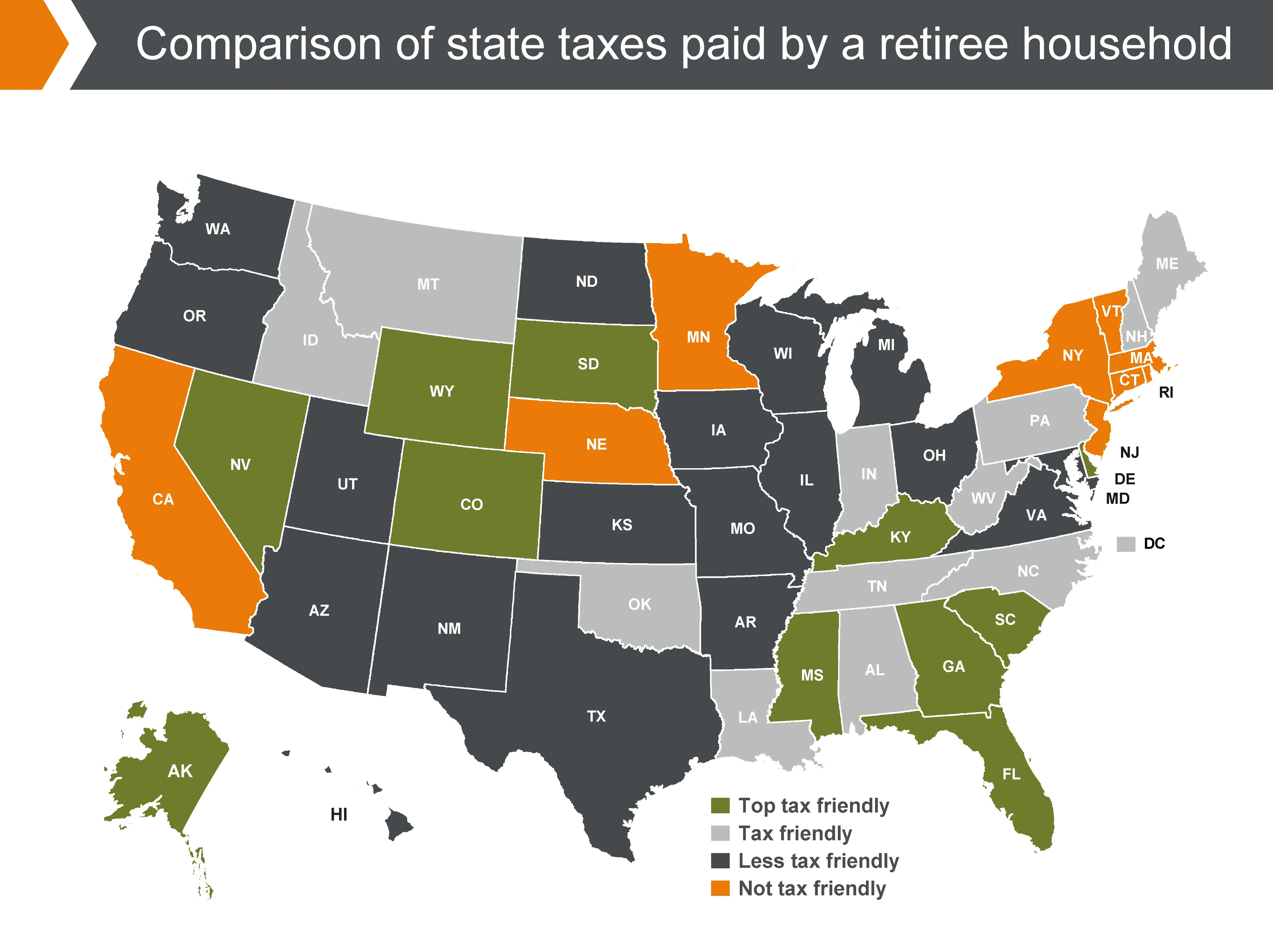

States With The Highest And Lowest Taxes For Retirees Money

Connecticut Sales Tax Guide And Calculator 2022 Taxjar

Connecticut State Tax Information Support

A Visual History Of Sales Tax Collection At Amazon Com Itep

Rhode Island Sales Tax Small Business Guide Truic

Do You Have To Pay Sales Tax On Internet Purchases Findlaw

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

Should You Be Charging Sales Tax On Your Online Store Retirement Income Income Tax Tax Free States

Sales Tax By State Is Saas Taxable Taxjar